This past week (19th to 23th July) I made a total loss of 166.78 USD in Stock Options Trading. 😒

The first week (6th to 9th July), I made 58.01 USD profits and in the second week (12th to 16th July) I made 1,146.81 USD.

If you have yet to read my week 2 options trading article, click here to find out more. 😉

My Options Progress Week 3 out of 4

This is an intermediate level investing article requiring experience in buying and selling Stock Options to digest the information which I will share below.

To reiterate the purpose of doing this 30 days challenge is to inform and educate beginner investors with less options trading experiences on what options trading could potentially be like.

There are still risks involved and proper research has to be performed for all investments including options. Be mentally prepared to cut losses when required and at the end of the day, you can suffer losses or make profits depending on your strategy and emotions.

Disclaimer: All information stated here are only for illustration and educational purposes. Its not financial advice to buy or sell any financial products. Please perform your own due diligence before investing as always.

Week 3 Progress 19th - 23th July 2021

- Each market trading day I would spent at most 3 to 4 hours doing research and monitoring the prices to buy and close the options.

- No speculating on ‘meme’ stocks. To trade in a systematic manner.

- To make it clear, the market opening hours at my side is 9.30pm to 4am (GMT +8).

- At the later half of last week, the S&P 500 was experiencing a mini correction and this continued forward into the following Monday (19th) of this week.

- The correction in price was at most a 3.3% decline from 15th to 19th July.

- However, from the 20th July onwards the market correction was short-lived with the reversal occurring so fast and swift.

- This was how the S&P 500 looked like for the past week as shown below. The stock market had recovered and continue to rise over the next 4 days till Friday.

- S&P was holding strong at the 50 day EMA support line (yellow line). It went down and swiftly bounced off that support line and continued its rise upwards.

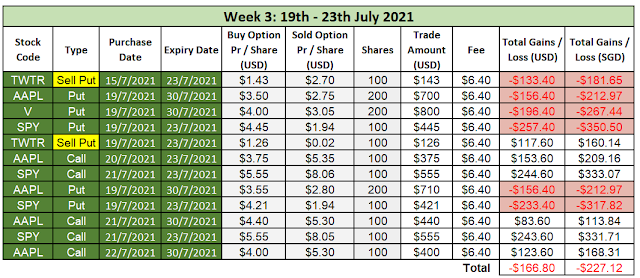

- Below are the options trades that I bought and closed for the past week.

19th July 2021

- From what I observed in the stock market, it was experiencing a correction on the 15th and 16th July. I sat back and waited, decided not to put in any orders.

- On 17th July, the stock market continued to drop downwards which constituted about -3% in prices, it was just a bloody red mess across all sectors.

- I looked at that first candle at 9.30pm (GMT +8), in the US is 9.30am when the market opened and decided to place my Buy Put Options on AAPL, V and SPY.

- I have my reasons so usually I don't do Buy Put Options, but I went ahead with it.

- Throughout that day, these options were still slightly profiting.

- However, as the day went on, I noticed that the selling momentum had dropped drastically. It started to plateau and moved sideways instead of going down.

- At 12am, I saw the market continued to dropped slightly and made the decision to continue to hold on till the next day and didn't exit in any of my Buy Put Options positions.

20th to 23 July 2021

- On the 20th July during pre-market from 4pm - 8pm (GMT +8), I saw that the prices in the market started to move upwards. That was not a good sign for sure. 😐

- I started to plan my exit strategy for my Buy Put Options, knowing from past experience that I had to act and close the orders swiftly to minimize total loss.

- At 9.30pm (GMT +8) when the market opened, I continued to observe the market movements and true enough, it continued its pre-market movement and it went up.

- This meant that most probably the price correction had already ended and the public was rushing in to buy stocks at discounted prices.

- I waited for 20 mins to see if there was any change in the candle stick pattern. No changed occurred and the market was very bullish. I decided to execute my exit plan and close my Buy Put Options one by one from 9.50pm onwards to cut losses. (This was also based on past experience and I knew right away that I needed to get out asap).

- Once I exited the Buy Put Options, I wasted no time and immediately place orders to Buy Call Options for the same companies that I had just exited for the Buy Put Options.

- Usually for beginners, once they just burnt their fingers in the market, they would take a break from the market to heal from the emotional losses and monetary losses. But I have experienced this situation a couple of times before, so I knew instinctively that I had to dive into the market right away and ride onto the upward market trend which I did.

- My strike price was at 144 USD.

- I bought at the first circle and exited on the second circle.

- Bought two lots of AAPL at first and decided to average down to buy one more lot.

- Decided to exit at the price of around 148 USD per share as its going very close to AAPL's all time high price at 150 USD per share.

SPY

- My strike price was at 430 USD.

- I bought at the first circle and exited on the second circle.

- Decided to exit at the price of around 437 USD per share as its going very close to SPY's all time high price at 437 USD per share.

- It not only reached that price but broke through and went even higher thereafter.

TWTR

- My Sell Put Option worked according to plan and I got +98% of the premiums.

- Twitter's second quarter earnings came out after the closure of the 22nd July market. There seemed to be some big movements during post market (circle part) but overall I felt that it didn't had much of an impact on its share price just saying. The price was already surging upwards before the earnings were published after 22nd July market closure.

- Just as what I have expected which is news coverage as such are just noise. Do not let this cause a distraction to your emotionally or to alter your investing plan just for this. Always stick to your investment plan objectively to buy and sell as always.

Will update week 4's which is the final week of stock options trading progress next week! 😁

0 comments