This past week (12th to 16th July) I made a total profit of 1,146.81 USD in Stock Options Trading. 😁

Last week (6th to 9th July), I made 58.01 USD profits in Stock Options Trading. If you have yet to read my week 1 options trading article, click here to find out more. 😉

This is an intermediate level investing article requiring experience of buying and selling Stock Options to digest the information which I will share below.

To reiterate the purpose of doing this 30 days challenge is that I want to inform and educate beginner investors with less options trading experiences on what options trading could potentially be like.

There are still risks involved and proper research has to be performed for all investments including options. Be mentally prepared to cut losses when required and at the end of the day, you can suffer losses or make profits depending on your strategy and emotions.

Disclaimer: All information stated here are only for illustration and educational purposes. Its not financial advice to buy or sell any financial products. Please perform your own due diligence before investing as always.

My Options Progress Week 2 out of 4

Week 2 Progress 12th - 16th July 2021

- Each market trading day I would spent at most 4 hours doing research and monitoring the prices to buy and close the options.

- 1204.82 USD / 9 days (week 1 & week 2) / 4 hours = A rate of +33.46 USD per hour for the time being.

- I was already anticipating a correction to occur in the stock market and it really happened this week. Thus, I decided to close all my stock options positions on Tuesday, 13 July 2021, don't delay any longer and take profits.

- Wednesday, Thursday and Friday was spent on just monitoring the market in the general. Didn't do any Buy Put Option except for just that TWTR Sell Put Option.

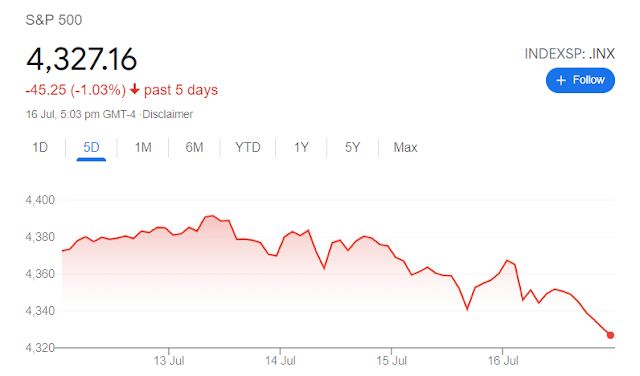

- This was how the S&P 500 looked like for the past week as shown below. It was moving sideways then the correction occurred at the second half of the week.

- This meme stock price was going down for almost 2 weeks from the 50 USD per share range. I had the chance to close the sell put option while its still a profit but I didn't as I see the time to expiry was still long so I kept it on. 😑

- However, each day the buying momentum was declining and once the price hit the 200 days EMA trendline, I knew the selling pressure was greater than the buying pressure.

- I closed this option and exited once the price broke lower than the support line at 39 USD per share.

- My strike price was at 431 USD.

- I bought in trenches, with the first lot costing me a higher premium amount.

- When the stock price of SPY started to correct along the way, I decided to average down and bought more lots at a cheaper premium amount for the same strike price.

- This lowered my overall holdings in SPY.

- I took a calculated risk as I saw that the price of SPY got chance will peak just high enough for me to exit and make a profit.

- When the SPY price peaked on Tuesday 13th July, I decided to close and exit my entire SPY call option to take profit as I don't see how the price of SPY will go any much higher than current before correcting.

- My strike price was 275 USD.

- This was the same case as the SPY option where I bought my first call option lot (blue circle area) at a super overvalued premium amount.

- Then the next thing I knew was that the price dropped. I didn't panic as I knew I had some time on my side as the option will expire the following week so I still could manage the time decay.

- When the price dropped, I decided to buy more lots (orange circle area) as its cheaper now. At the same time, I average down my premium cost for the options.

- When the price rose (brown circle area), I decided to exit and take profit based on my strategy.

- I didn't bother to wait a day later or longer to see if the price could go even higher (it actually did went up higher alittle) as I didn't want to take the risk.

- My strike price was 207.5 USD.

- If I held it longer, I would have gotten a higher profit.

- Though this one I bought and sold on the same day, it was to mitigate the risk that the price will erratically drop further.

- My strike price was 65 USD.

- This one I bought about 45 mins too early in that day. Should have waited longer to see the trend and where it was heading.

- Decided to exit as the S&P and QQQ index prices were declining rapidly. These created huge fear and selling pressure for most stocks including this one.

- Not a wise move to do a Sell Put option in the midst of a market correction.

0 comments