- There are ways to maximise your returns from Robo-Advisors. Its not difficult to do so and everyone is able to get this right once you understand what you are doing. 😀

- Previously I wrote an article to list down some points on what were the cons with diversification in investing in general. Click here to read it.

- Now I am going to share some intermediate level tips on how to reduce your diversification using Robo-Advisors and maximise your returns.

- This article is only meant for those who have some experience using Robo-Advisors.

- Overdiversification across multiple Robo-Advisor platforms

- Overdiversification within a Robo-Advisor

- Maximise your returns within a Robo-Advisor

Background:

- Before we proceed onto the next section, I have been using Robo-Advisors since mid-2019.

- There are multiple platforms which started to mushroom around that period of time till today. However, I have a penchant to only use those Robo that comes with a mobile application due to the convenience. 😄

- Till date I have tried and tested out every single feature available at this point of time in the Stashaway, Syfe and UOB AM Invest, these three Robo-Advisor platforms.

- I like to try every single feature in order to fully understand and comprehend the mechanism behind the investing tool. This is to built up my knowledge and know-how in all these stuffs quickly without relying solely on reading other people reviews.

- Thus, with this in mind, I am able to find out what are the true potential returns per year for Robo-Advisor and that's the reason why this is an investing tool which I will encourage new investors to use to make slightly more money while they sleep and at the same time get their feet wet first. 😄

- Click here to read my review on Stashaway

- Click here to read my review on Syfe

1. Overdiversification across multiple Robo-Advisor

- There are just too many Robo-Advisors out there in the market now. Do a quick google and multiple names will appear on your search result.

- The goal is choose the one that you feel the most like trying and being convicted after reading 3rd party reviews online.

- For myself, I tried three different Robo-Advisor platforms. However, I am slowly reducing my diversification from 3 to 2 then from 2 to now just 1 platform. Currently I am holding just Stashaway and nothing more.

- I am planning to exit this last Robo soon (below is the screenshot) as I have already found other ways to better maximise my money while I sleep. Below is my current Stashaway portfolio performance.

Investment Duration: Slightly over 1 year period

Portfolio: 36% risk index (most aggressive)

Current Return: 799SGD or 12.3% per annum

Highest Return Recorded: 1144SGD or 20.8% per annum (just before the big market correction on 18th Feb 2021)

DCA: Every month

- I have built from scratch successfully a few different Robo portfolios and exited to take profits. Its really not that difficult to build these as the real hard work is done behind the scenes by the Robo-advisors themselves.

- Reason for holding onto 1 Robo instead of 2 or 3 Robos is the fact that each Robo-Advisor has their own methodology to invest your funds, meaning their return of investments (ROI) are different across the board.

- eg. Endowus ROI can be 8% per annum while Syfe ROI can be 10% per annum depending on which platform you use and within each platform, which plan you decide to on-board.

- To illustrate to you what I meant here using math:

- Not only that, you have to constantly open multiple tabs to view your investments separately and the truth is investing should not have to be so complicated. Moreover, there will be some new features and changes to the existing plans as each Robo will tend to make some minor changes every few months or so to counter new macro-economical forces.

- From the sample math which I shown above, putting all your eggs into 4 baskets may not always lead to a higher return. In this case, putting your eggs all into one common basket is more rational and the returns are higher overall. 😂

- Also, some Robo has additional incentives where you will have to deposit a certain amount of cash into their platform and they will reward you by letting you pay lesser management fees per month as well. Go read up more and you will know! 😌

- Final thoughts is holding on to just one Robo is sufficient.

2. Overdiversification within a Robo-Advisor

- At the very beginning when each Robo-Advisor launches into the market, usually they will introduce just one or two flagship investment products. After some time, they will start to roll out more and more new investment products and it becomes so many, such that its making retail investors more confused than actually helping them to solve their investment problems. 😂

- Here is one real life sample for you.

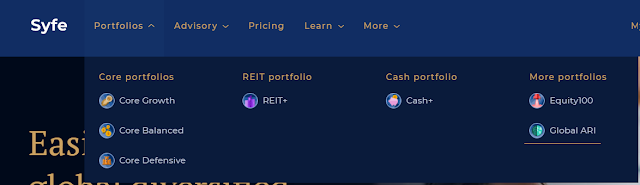

- Currently there are 7 investment products launched by Syfe.

- At the beginning when I first started using last year, there were only two types of investment products available which are REIT+ portfolio and Global ARI portfolio. 😂

- Like I said previously, investing should not be too complicated. Later on, Equity 100 portfolio was launched, then Cash+ came out, followed by the newest baby in the market which are the three types of Core Portfolios. Some of the portfolio contents actually overlap with each other so you just have to research and do the comparison to distinguish and you will be alright.

- Although there are so many different plans/portfolio to choose from in Syfe, please do not try more than 1. Having just 1 plan is sufficient to maximise your returns. The issue is still the same as what I have shared under point 1. Whether you invest into different Robo platforms or multiple portfolios within a Robo, this will not always lead to higher returns compared to concentration into 1 Robo only and 1 portfolio only strategy.

- For myself, I have tried before REITs+ portfolio, Global ARI portfolio, Cash+ and Equity100 portfolio.

- Equity100 by far was the best one that I have used so far and it gave me the highest returns as well. I couldn't be bothered to go into the 3 types of Core Portfolio as some of their investment contents have some overlapped with the Equity100 one.

- Please do not follow what I did previously and always do your research and focus on just 1 portfolio in this case based on your risk appetite and investment horizon.

3. Maximise your returns within a Robo-Advisor

- I have received many feedbacks from my friends and also reading online comments about losing money while investing in Robo-Advisors.

- The few reasons why you are making losses are as follows:

- Depositing too little cash, fractional investing (<1000 SGD) 😮

- Lump sum investing, not DCA-ing regularly 😅

- Withdrawing your funds when a bear market / market correction happens 😨

- I will like to reiterate that Robo-investing is not a quick rich scheme to get rich. It can help to preserve or increase your wealth to a certain extend and not overnight grow your investment of 5k into a 10k.

- Although Robo allows you to deposit any amount as little as 50 SGD etc, please note that when you deposit an amount that is too small (rule of thumb <1000 SGD), Robo will do fractional investing on your behalf.

- You open your Robo-Advisor portfolio, under transaction history you will notice that some of it they will purchase using fractional shares eg. stock ABC bought 312.56 shares in May 2021.

- 0.56 shares is considered as fractional investing, meaning that you don't have enough to buy 313 shares thus, they will buy with whatever funds you have which is enough to get you 312.56 shares.

- eg. if one of the stock in your chosen Robo portfolio is worth 500 SGD per share and you only deposit 50 SGD, you will be purchasing only 50/500 = 0.1 fractional shares instead. Any gains will be insignificant as the amount of shares you hold in your Robo is just too small. Thus, it will take longer time for you to see positive returns compared to someone else who place a higher amount of funds at the beginning.

Lump sum investing, not DCA-ing regularly

- This can be as such where you invest eg. 10k SGD into a particular Robo portfolio / plan at the beginning and thereafter, you just sit back and watch your portfolio slowly decline, not knowing what happened and cursing at the Robo for making you lose money.

- When you perform lump sum investing, you are more highly affected / impacted by the performance of the market compared to DCA due to the lesser number of investing points. Let me illustrate and hope that this will enlighten you to think deeper from now onwards. 😁

- The only way to counter this is to DCA regularly which is what I am doing currently.

- This will require understanding the concept of "Dollar Cost Averaging" (DCA) and more in-depth of how this will affect your investment returns.

- DCA is the action of regularly buying more into a particular investment asset at defined periods such as daily / weekly / monthly etc. The action of buying more can either be by number of shares (10 number of shares per month) or cash amount (only $200 to use per month).

- This is the opposite of lump sum investment where you deposit money to buy an investment asset at the beginning only and thereafter, no more funds are introduced to purchase more in the future.

- When you DCA, you create more investment points throughout and you are able to average down your overall stock price as you are forced to buy into the market regularly ignoring the price of the market.

- If the market is doing well and price increases, you will buy lesser shares and when the market is doing poorly and price decreases, you will be able to buy more shares.

- On 1st Oct you are able to purchase 15 shares of SPY while with the same amount, you could only purchase 14 shares of SPY due to market price fluctuations.

- In this sample example, with DCA, you are able to buy a total of 29 shares with 10,000 SGD compared to lump sum investing where you could only buy 28 shares with the same 10,000 SGD.

- Furthermore, by DCA-ing, your average price per stock is lower at $344.82 versus the lump sum investing stock price of $352.60.

- If you DCA just like what I shared above, as long as the current stock market price for SPY is above $344.82, YOU WILL CONFIRM MAKE A PROFIT!!!

- This is the most important basic concept that you must know in order to understand why you are losing money when you invest in Robo. I hope you get what I am trying to show here. 😊

- Taking reference from the above sample example. The cost price per share is $344.82 for DCA-ing and owning 29 shares of SPY stock.

- If the current stock price is lower than $344.82 please do not make the impulsive decision to sell it right away.

- Hold on to it with your diamond hands and wait for the market correction to be over.

- Once the stock price goes higher than your cost price per share of $344.82 in the long run, you will see positive returns again.

Hope that this will motivate you to ponder and think deep whenever you do any investments. 😁