Rationality To Invest

- The fear of missing out (FOMO) on the next stock market bull run, market bottom, rise in bitcoin prices. dreaming of owning multiple income streams and many others have led to one making irrational decisions to enter a particular trade / order.

- To be honest, there will be many more opportunities in the future, no need to rush into this and lose money now you know. 😂 Once you master the technique of investing, you will be able to generate higher returns.

- Take some time to reflect and think through ya. The more important question to ask yourself is, are you fundamentally ready and comfortable to start investing? 😵

- I put together a list of 11 basic FAQ below and you have to ask yourself if you meet these basic requirements at the very minimum?

1. How much money does one need to start investing in anything regardless of stocks, bonds, fixed deposits etc?

- I would say at least 5000 SGD to 8000 SGD at the very minimum in your bank savings account now as a gauge.

- If you currently don't even own 5000 SGD in your bank account, forget about investing. Learn how to budget your expenses, focus on growing and saving your income first as you require that amount for your daily necessity spending.

2. How many years of investing / financial knowledge do one need to start?

- If you possess less than 1 year, forget about it. You can start small and try just like I did. But don't even think about getting rich or making money through investing at this moment of time.

- You will lose money more than making profits at this stage if you enter a trade / order as you have yet to develop your fundamental financial knowledge and acumen to navigate in this environment.

- Use the time to read up on more books, watch more YouTube and read more investing forums to catch up on what is happening. You will know that you are ready when the time feels right. Trust me, I have been there and done that. 😉

3. Is there a right time to invest?

- The stock market bottoms are definitely the best time to invest as things are dirt cheap but the issue is nobody can predict the actual bottoms you know what I mean hahaha. 😂

- For me, instead of focusing all your energy to find the 'ideal' time, just start somewhere when you are feeling comfortable to invest. It can be Fixed Deposits, High Savings Account, Bonds, Robo, Stocks etc it really does not matter.

- Most importantly is to take your first step and start taking massive actions 💪to explore the different financial products out there. You will learn and grow along the way trust me. 😃

4. What goes into your mind when you see a -$4000 in your investment? 😱

- It is definitely an emotional roller-coaster to encounter this personally in the stock market and it will take some time to get used to for sure.

- If this is not for you, fret not there are passive investment activities out there as well.

- Building up your stock market psychology requires constant practice and this brings me to the next point below.

5. Do one sit back and relax after entering a position / order?

- Absolutely not!! Before you buy a particular financial instrument, you must plan for your stop-loss strategy eg. to hold for how long, what price to exit and what price to scale up. This ensures that you make decisions rationally and not based on market emotions.

6. Do you set goals before investing?

- Goal setting is extremely important as this determines your time horizon to invest and how much risk you should get exposed to reach your desired goal.

- eg. I want to earn $3000 within 6 months as a travel budget to spend when I go to Thailand for a holiday.

- With that time and amount, this will set you up for higher risk investing methods such as options trading etc and forgoing fixed deposits as you will never earn $3000 in 6 months with the latter. If you get what I mean hahahah 😂

7. Are you risk-adverse or a risk-taker?

- There are risk-adverse (able to preserve your principal sum invested) strategies out there such as bonds, fixed deposits, ETF, Robo-advisor etc

- There are risk taking (possible to lose 100% of your principal sum invested) strategies out there such as individual stock picking, options, crypto investing, futures etc.

- The list is not exhaustive. What you do actually depends on your risk appetite, comfort level and the amount of effort you are willing to put in to be active in your investments. Of course, to put it upfront is that risk-adverse strategies will not make you rich overnight.

8. Is there such thing as scaling up in Investing?

- Yes, I do believe and have been practicing this approach. This is most critical for those with less than 1 year of investing experience.

- eg. If I have 2000 SGD of spare cash to invest. To purchase a lot of a stock which cost $1000, I will not go all in and spend my entire sum to buy 2 lots of that stock. What I would do is just buy one lot of $1000 and see how that stock performs first before deciding at a later time to hold or purchase the 2nd lot of shares.

- Investing is similar to running a business if you can visualize and see where I am coming from. You need time to grow the business and never expect to make fast cash through investing. If you see yourself or others making fast cash, that is gambling and not investing.

- eg. You decided to purchase an empty plot of land from a landlord with the goal of selling chicken rice. You have to put in the hard work to renovate the land, buy furniture, hire people and most importantly open and start selling chicken rice before you can generate revenue to cover your cost and ultimately earn profits to make this a sustainable business. There are no shortcuts or easy way out. 😙

9. Does the 50-30-20 allocation of your monthly salary rule actually work?

- Meaning to allocate 50% of your salary to necessity expenditures, 30% to savings and 20% to investments.

- I always read about this rule online but I myself don't follow this as I don't believe in this.

- This is just a framework to govern those who are not sure on what to do with their monthly salary. For me, you have to be comfortable in the allocation amount of your choice, see what works best for you and not just blindly follow some allocation. Its definitely alright if you want to allocate 50% to savings or even 50% to investing depending on what is your goal at this point of time.

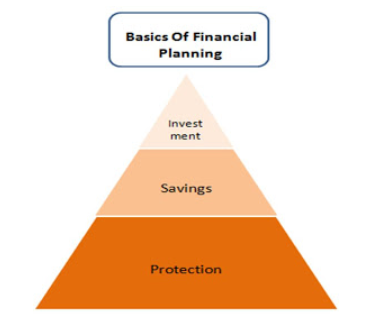

10. Should one focus on which first? Savings, Investing or Insurance?

- For me, focus on savings to build up your war chest so that you have enough ammunition when the right time comes to invest.

- Next, go get the right protection and purchase the necessary Life and Health insurances. This is able to protect you and your loved ones with the large coverage during raining days. Investing will not be able to provide for this as it takes time for your portfolio to grow in the longer term.

- Only when these two aspects are settled and stable, then can you start to focus on investing with a peach of mind. 😌

11. One should save or invest?

- Food for thought! This is a simple flow chart to guide you in your decision to save or invest. Click here to find out more.

- For those who are comfortable to start investing or have started to invest, I will go more in-depth to the different financial instruments that I have used the next blog post. Stay tuned! 😃

Once you have fully understood the 11 points that I have mentioned above. You can read the next blog where I covered the different kinds of investing tools in the market. Click here to find out more.

0 comments