Invest in PancakeSwap Liquidity Mining on Binance Smart Chain (BSC)

I have been using PancakeSwap for at least half a year. I will be penning down my thoughts and opinions based on my personal experiences using this platform for Liquidity Mining (Yield Farming).

Disclaimer: All information stated here is only for illustration and educational purposes. It's not financial advice to buy or sell any financial products. Please perform your own due diligence before investing as always.

What is this about?

PancakeSwap is a decentralised exchange (DEX) on the Binance Smart Chain. DEX is an online exchange that has no centralised governance or intermediary.

PancakeSwap is the biggest DEX on the Binance blockchain. Each blockchain will have its own DEX and competitors.

Initially, I was watching some Youtube videos of Liquidity Mining and Staking on PancakeSwap and I was super fascinated by the usage of super cool and cute names such as cakes, bakes and all those words to build its brand.

It tried to differentiate itself from Etherum's Uniswap as a faster and cheaper alternative in gas fees. Those who are familiar with this situation will know about the astronomical gas fees on Ethereum for just doing basic withdrawals or purchase of NFTs.

I decided to give it a go and see how this works. PancakeSwap can be accessed on both laptop and mobile as long as you connect it to your own Binance wallet to sync your account to the exchange.

For myself, I am using Trust Wallet to get access to Pancake Swap on my mobile so I don't really use the computer version at the moment. Trust Wallet got acquired by Binance so I decided to use this and not Metamask.

Native Coin - CAKE

As always, it needs a coin in order for the exchange to function just like any other blockchain. The native coin in this case is CAKE.

At this current moment, they are ranked #54 from the list of cryptocurrency coins based on market capitalisation. As long as you want to use the platform, chances are, you will require to buy some PancakeSwap coins to do your LM or staking activities.

PancakeSwap Platform

They have redesigned the platform just 4 to 5 months ago so the interface is slightly different from how it looked on your screen before.

Anyone can just enter into the website. But to start using its features, you will need to connect a crypto wallet to the platform first. I am connecting my Trust Wallet to this. Did not use Metalmask or other wallets whatsoever.

I self-learn all these parts such as setting up my own Trust Wallet account and connecting the wallet to Pancake Swap to start using its features. There are tons of tutorials online so just watch and follow according. If I could do it, so can you. 😄

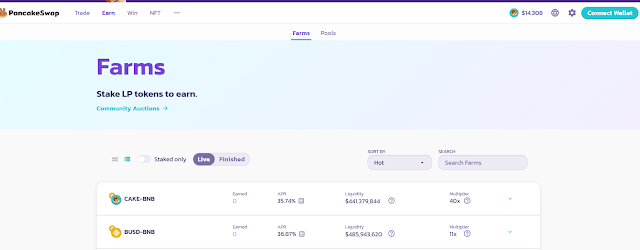

Once you enter into the platform, you will be greeted by this new interface design as shown.

There are various tabs on the top of the interface. The most important function that people will use will be ‘EARN'.

EARN has two subheaders called 'Farm' and 'Pool'

In essence, Farm is your Liquidity Mining (LM) feature and Pool is your staking feature.

The rest of the other features are NFTs, buying and selling crypto coins on the exchange which I will not run through in this post.

What is Liquidity Mining (LM)?

Liquidity Mining (yield farming) is people like you and me choosing to deposit a pair of two different crypto coins into a liquidity pool on a Decentralized Exchange (DEX) such as the one that I am going through is PancakeSwap for Binance Blockchain.

You have to provide an equal monetary amount for both coins into the LM pool to participate.

In return, you will receive a reward from the specific liquidity pool to which you provided liquidity.

Usually, the reward percentage is super high from 20% to 400% kind of number. But please do not be deceived by the high APR/ APY. There is no free lunch in this world. Those high numbers are used to attract people to deposit liquidity into the pool.

Normally, an LM pool with a higher APR/APY will have more risk such as the pool getting shut down one day without any notice etc. This was what I had experienced first-hand.

Liquidity Mining Pool (First Try on PancakeSwap)

XMARK - BUSD Pool

I decided to give it a try. I first prepared some stablecoins and deposited them into my Trust Wallet. I then opened the PancakeSwap application inside the Trust Wallet app. Click on Dapps and search for PancakeSwap from the search bar. Click it and open it.

Once I went in, I swapped the stablecoins into an equal amount of XMARK and BSUD coins which I needed for the LM later. This function can be found under the Trade tab as shown in the screenshot.

Once I have the coins, I would proceed to the second tab EARN and select FARM.

Initially, the reward return was around 180% per year and things were all good and rosy. But as time goes by, I started to notice a drop in reward returns from 180% to 140% to 100% to 80% to 50%, etc.

This is the current status of the XMARK-BUSD LM pool. The pool is currently empty. I was dumbfounded just like you as well when I opened this page one day in Q4 of 2021.

I went to check online and found out that Binance mentioned on their official page that this XMARK-BUSD LM pool was not very popular on their listings, and it was of the many LM pools that were shut down and closed on their platform. This was done so that people could continue to provide liquidity for the more popular pools. 😤

XMARK is a crypto that has higher risks as it is not yet proven or adopted by the masses yet.

I was like, how can this even happen?😒I thought the purpose of the DEX is to be a decentralised exchange so having a central authority like Binance coming in to stop the pool was something unbelievable on their end.

It was a nerve-wracking moment for me. From that experience, I knew that the LM pools are just a tool in this space. There are many LM pools floating around in different blockchains and different DEX platforms around the crypto space.

With the right resources, one can open and start an LM pool and invite people to provide liquidity so please be sure and do your own research to know whether is the pool safe to deposit your money inside.

Just remember before you invest in any LM pools, we do not need the LM pool to survive in life, but the LM pool will need all of our money and liquidity in order for the pool to run and function as programmed to. They need us more than we actually need them.

They have the incentive (agenda) to publish and show very high APR / APY reward figures to attract you to provide liquidity for them and these high numbers might change in the future. Remember this!

Liquidity Mining Pool (Second Try on PancakeSwap)

CAKE - BUSD Pool

Nevertheless, I did a second attempt on LM in PancakeSwap for CAKE-BUSD. This time, I decided to play safe and chose this pairing. CAKE is the native token for PancakeSwap so I have confidence in this coin on its utility. On the other hand, BUSD is a stable coin so I am more confident on this as well.

For now, it is still doing fine at the moment with a reward percentage of 41% APR. This percentage will keep changing every now and then so it is definitely not a fixed figure.

Every time when I earn some CAKE from this LM pool, I will harvest and transfer it to my CAKE staking pool in the Pool tab as shown with an APY of 64%. Again, this APY figure is not fixed and it will fluctuate as well.

For now, I am not very convicted on LM pools in PancakeSwap, so I plan to run this for a while more and exit during the next crypto bull run.

To me, there are just too many LM pools in the market right now. It is still very possible for more LM pools to shut down suddenly just like what happened to my XMARK-BUSD LM pool previously, so I don't really see this as a long term investment product in my honest opinion.

0 comments